The 70 20 10 Budget Rule

06 May 2023

How do you manage your budget every month?

Everyone will have: different circumstances, salary levels, be subject to different expenses, and more, which will influence how they can best manage their finances.

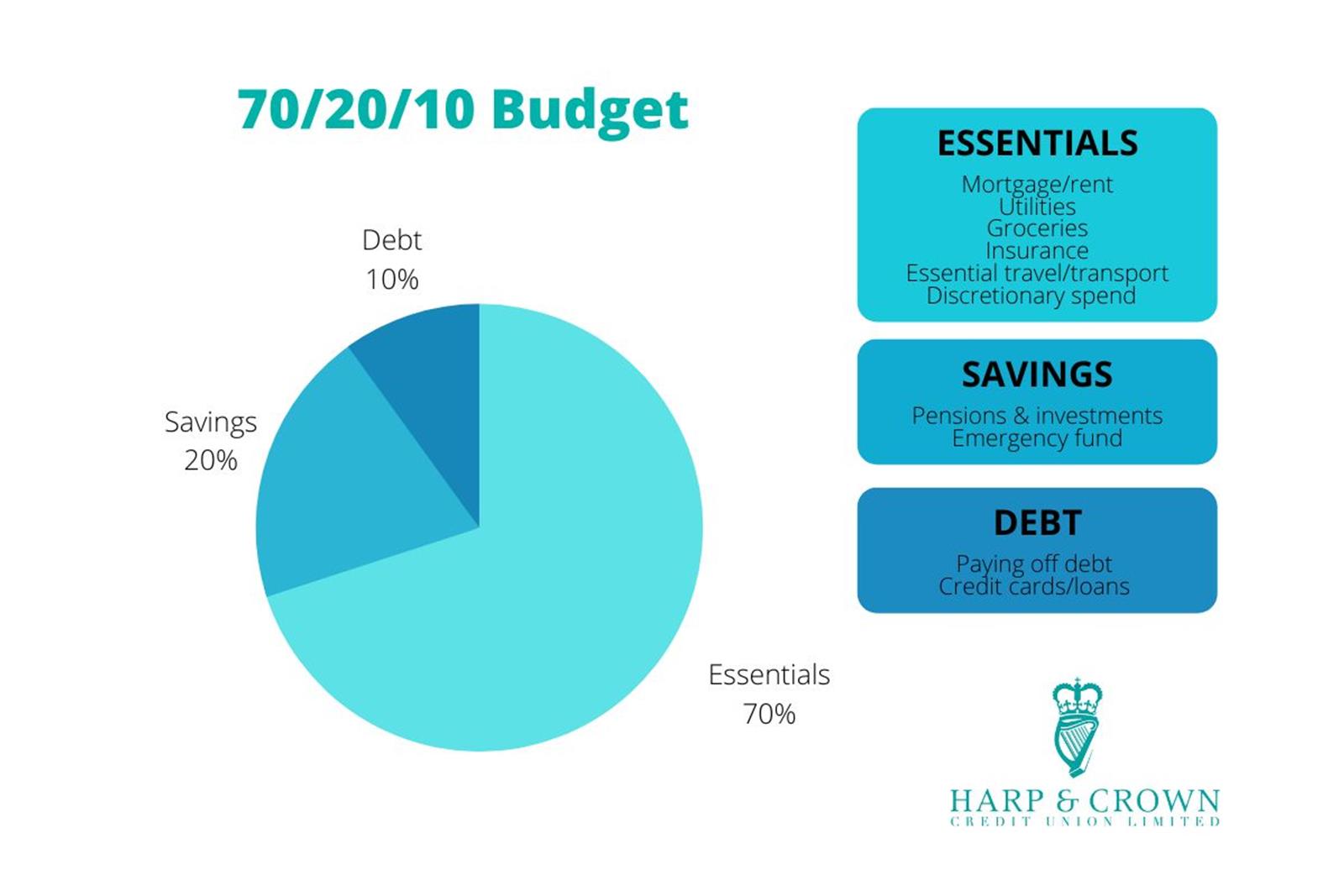

70/20/10 Budget

Based on a US concept, the 70/20/10 Budget has been adapted from the 50/30/20 rule, which focuses on 50% of your monthly salary going on needs, 30% on wants and 20% on savings.

Given the cost of inflation and cost of living in general, it’s just not possible for the average consumer to allocate as much as 30% of their salary on “wants”.

If you do not have any debt, however, you could and should consider allocating more of your salary into savings each month as a buffer for the days ahead.

Remember…choose a budget plan best suited for you and your circumstances!

Email creditunion@harpandcrown.co.uk or phone 028 9068 5198 between 9am - 5pm.

“Save regularly and borrow only what you need.”

The Harp and Crown Credit Union provides safe, secure, flexible finances for the wider police family in Northern Ireland.