Debt Consolidation Case Study Oct 22

21 October 2022

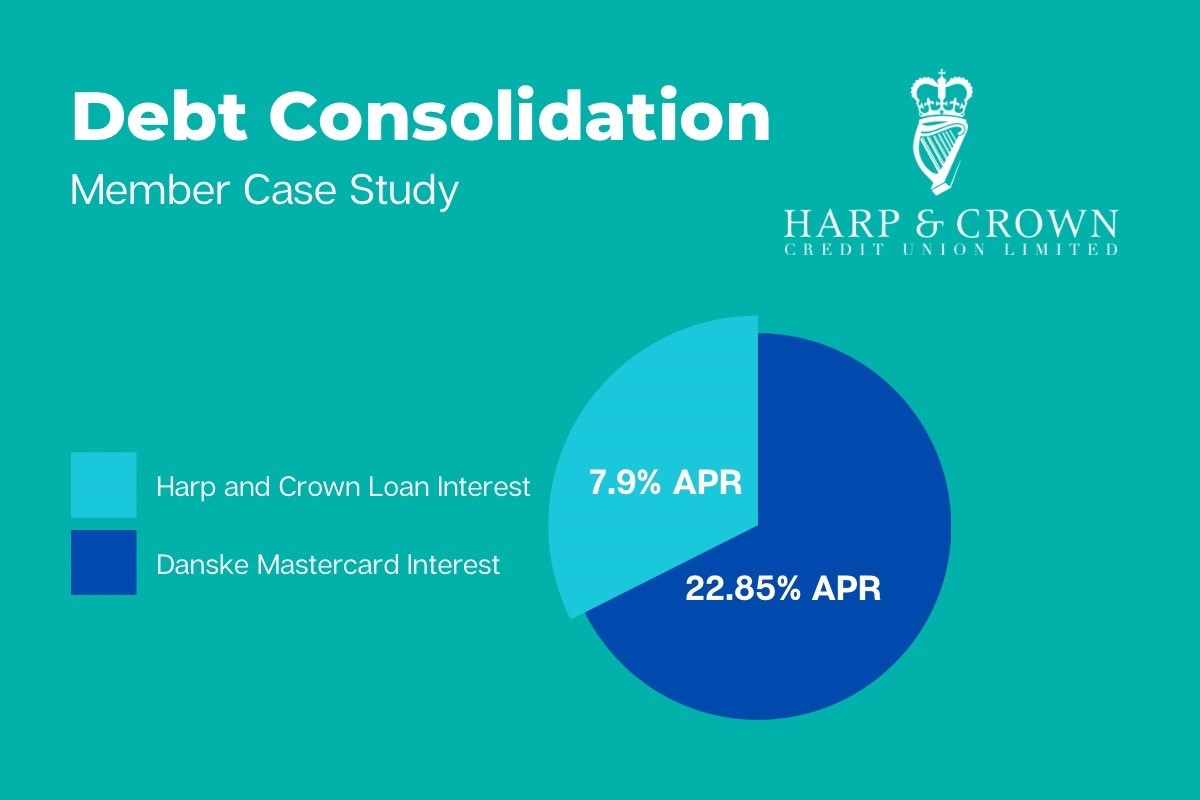

This month we helped a Harp and Crown Credit Union member consolidate a high interest credit card into one of our lower interest rate loans.

The member had over £5,000 to pay on a Danske Mastercard (currently 22.85% APR) and was only paying the minimum payment each month.

According to MoneySavingExpert.com the average time to pay off a £3,000 credit card could be around 28 years, if the debtor is only paying back the MINIMUM each month!

Our loans team were able to cut the member’s debt interest payable by around 66%, with their new Harp and Crown loan taken over 48 months, at a very competitive interest rate of 7.9% APR.

Find out how you might be able to save on interest / pay off debt sooner, with one of our debt consolidation loans.

Email creditunion@harpandcrown.co.uk or phone 028 9068 5198.

“Save regularly and borrow only what you need.”