Harp and Crown CU members! Please be assured our LOANS remain at the SAME lower interest rates!

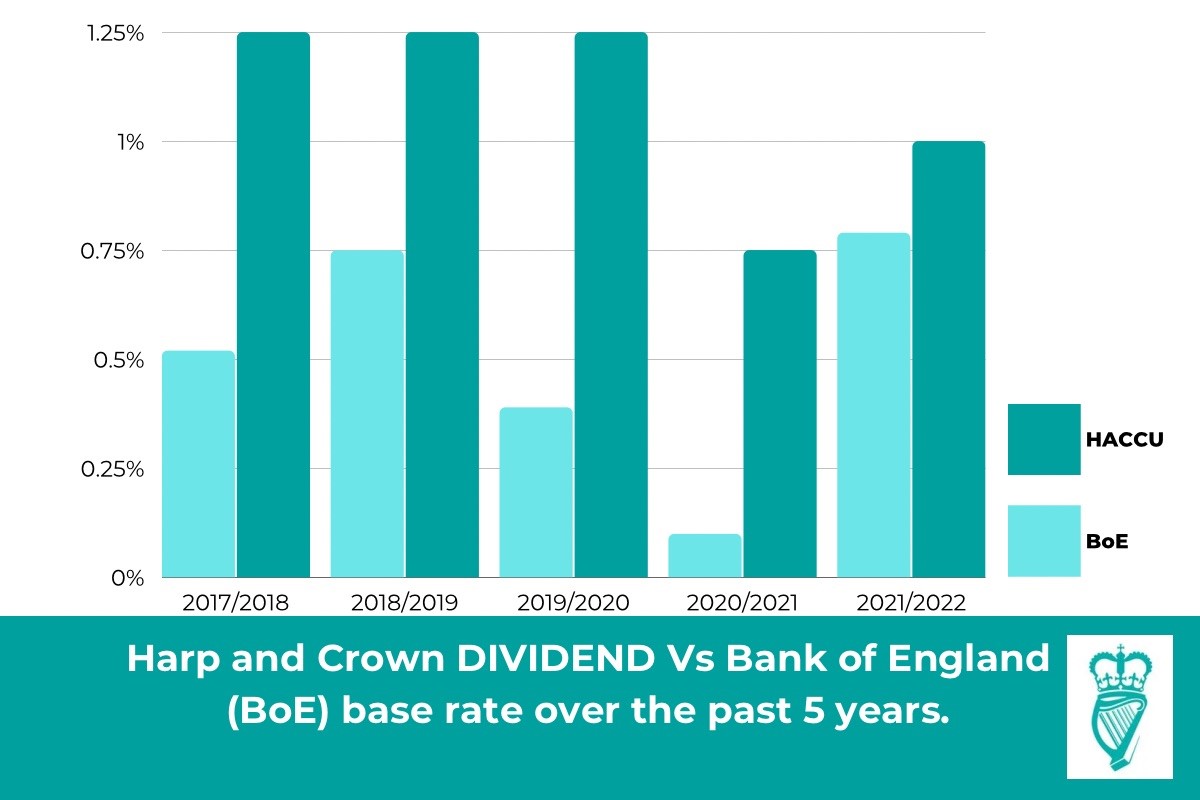

Apart from ONE great reason alone…the increase in Bank of England rates…and our lower interest rates remaining the same…here's why you should visit your credit union FIRST before approaching a bank for a loan.

Need help financing a holiday, car, home improvement, credit card debt and more? And in an ethical, flexible and affordable way?

Apart from ONE great reason alone…the increase in Bank of England rates…and our lower interest rates remaining the same…here's why you should visit your credit union FIRST before approaching a bank for a loan.

As we near the end of our financial year (running from Oct-Sept) we’re reflecting on the BENEFITS of being a Harp and Crown Credit Union member!

Is your CREDIT CARD nearly maxed out from Christmas spends?

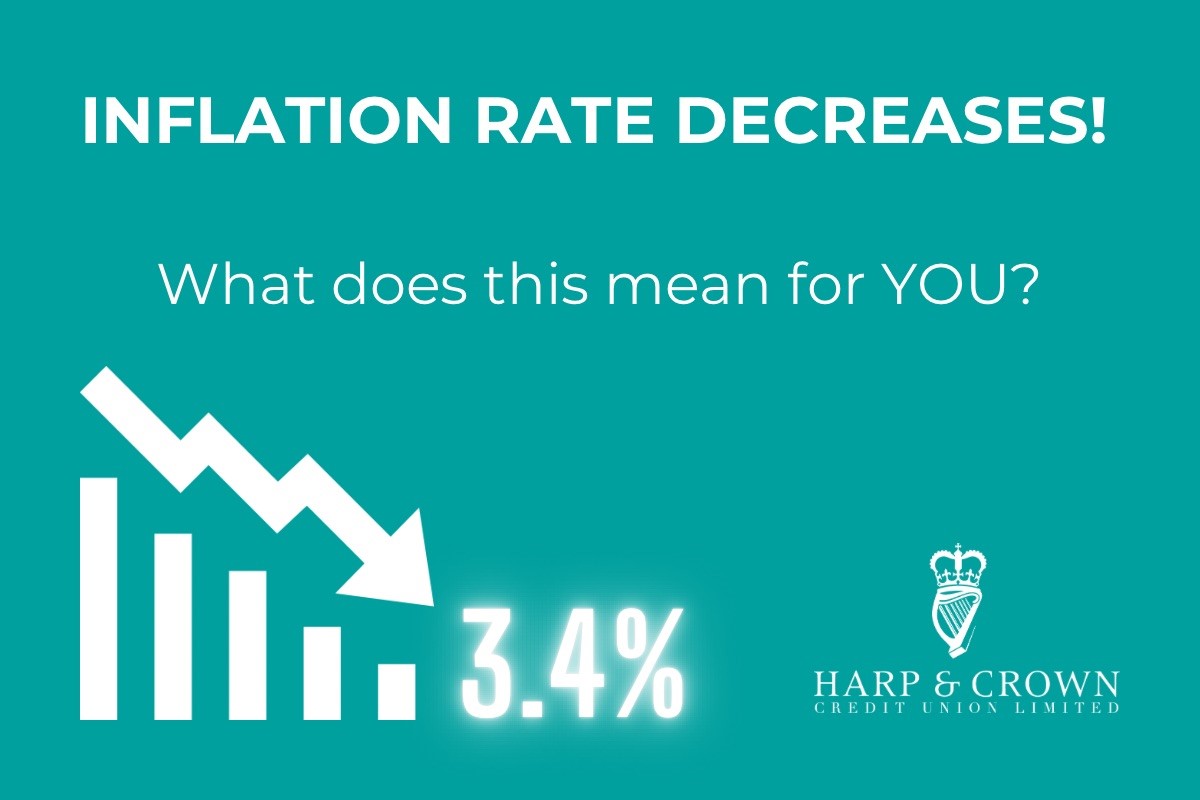

Inflation, the rate at which prices rise over time, has been slowly falling. In October 2022 the UK hit its highest rate in 40 years at 11.1%.